Key details

- The Brisbane Fringe office market comprised of around 1.23 million square metres of stock in July 2021, it’s Australia’s largest non-CBD office market.

- This market makes up nearly one-third of Brisbane’s entire metropolitan office stock.

- Around 50% of the markets office stock is A grade, with 36% B grade space

- The Urban Renewal precinct development activity has increased stock to around 521,000 square metres or 43% of the Fringe’s total. This growth is likely to continue with new development in the Fortitude Valley and Newstead area.

- Negative net absorption of around 23,000 square metres.

- Incentives and competition for tenants remain high, while tenant demand is weaker due to covid workplace uncertainty.

- A vacancy rate of 16.1%, as well as relatively stable rents, means there are no strong driving factors for CBD tenants to consider re-locating to the Fringe or Fringe tenants to (re-) centralise.

- New supply is under construction in both the CBD and Fringe. FY2022 will see the addition of 60,000 square metres of new office space to existing Fringe stock, equivalent to an increase of 4.9%.

- Major projects under construction - 152 Wharf Street, Spring Hill - 895 Ann Street, Fortitude Valley - 31 Duncan Street, Fortitude Valley.

- More than a dozen other projects either hold development approval or have recently applied.

The state of play

In July 2021, the Brisbane Fringe office market comprised around 1.23 million square metres of stock based on the Property Council of Australia’s (PCA) July 2021 Office Market Report. The five precincts that make up the Fringe are, collectively, Australia’s largest non-CBD office market and make up nearly one third of Brisbane’s entire metropolitan office stock.

Around 50% of the Fringe’s office stock is classified as A grade, with the remainder largely made up of B Grade space (36%). While the share of higher quality office stock increased significantly during the last major development phase (2008 to 2015), it is below the share of ‘prime’ space in the Brisbane CBD (56%).

The Urban Renewal precinct has been dominating development activity for over the past 10 years, with its stock increasing to around 521,000 square metres or 43% of the Fringe’s total (see chart below). Its share is likely to increase further as most of the proposed new developments are located in the Fortitude Valley and Newstead area.

he COVID-19 pandemic. We forecast that A Grade rents will grow by 13% over this period.

Our early read is that displaced occupiers will try to remain within the City Core precinct. Accordingly, we expect that the City Core will outperform the broader market.

Net absorption

According to the PCA, the 12 months to July 2021 saw negative net absorption of around 23,000 square metres across the Fringe, a worsening compared with FY2020. However, all the negative net absorption occurred in the 6 months to December 2020, with most of the damage related to Virgin Australia and Flight Centre, both victims of Covid-19-related travel restrictions.

In contrast, the market recorded positive net absorption of 14,000 square metres recorded during the first half of 2021. The turnaround was mostly the result of Mater Group moving into their new headquarters in Newstead from premises that were not classified as office. Nonetheless, another increase in sub-lease space points to the ongoing challenge the pandemic poses for office demand, despite encouraging ABS figures for employment growth since September last year.

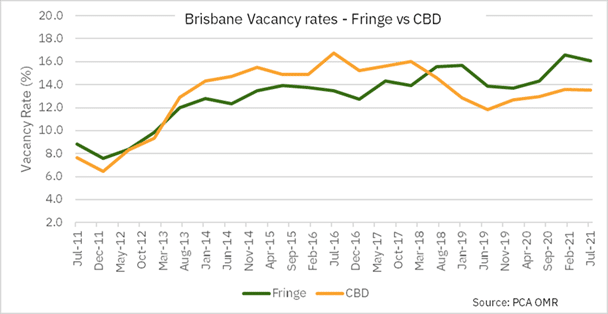

Vacancy rates

Vacancy rates of 13.5% and 16.1% respectively in the CBD and the Fringe, as well as relatively stable rents, means there are no strong driving factors for CBD tenants to consider re-locating to the Fringe or Fringe tenants to (re-) centralise. Moreover, there are significant amounts of new space under construction in both markets to accommodate any given level of demand in the short term.

For further insights read the full Brisbane Fringe Office Market Report

Title image by Rothelowman