A money bag with the word Risk and a bank building on each side of a seesaw | © shutterstock.com (modified)

A money bag with the word Risk and a bank building on each side of a seesaw | © shutterstock.com (modified)

This blog is part of this year’s series of posts by PhD students on the job market.

The Global Financial Crisis and the ensuing persistently low interest rate environment have fostered a reconsideration of the role of financial stability in the conduct of monetary policy. Financial crises are often preceded by increased risk taking on the part of banks, which lays the seeds for a subsequent financial panic. At the same time, banks tend to accumulate risks on their assets in the balance sheets when risk premia shrink due to low-interest rate environments, which then incentivizes them to “search for yield.” Concerns about banks’ yield-seeking behavior have become even more crucial recently because of the additional drop in policy rates following the onset of the COVID-19 pandemic. As long as traditional macroprudential policy tools effectively manage financial instability risks, monetary policy should focus on stabilizing prices. However, there are practical limitations to deploying time-varying macroprudential tools, such as jurisdiction constraints and concerns about regulatory arbitrage. If the usual macroprudential policy tools are not fully effective in managing financial instability risks, should central banks address the buildup of bank risk taking with monetary policy? Specifically, if interest rates alter banks’ risk taking, is it efficient for central banks to account for the risk of financial panics when setting interest rates?

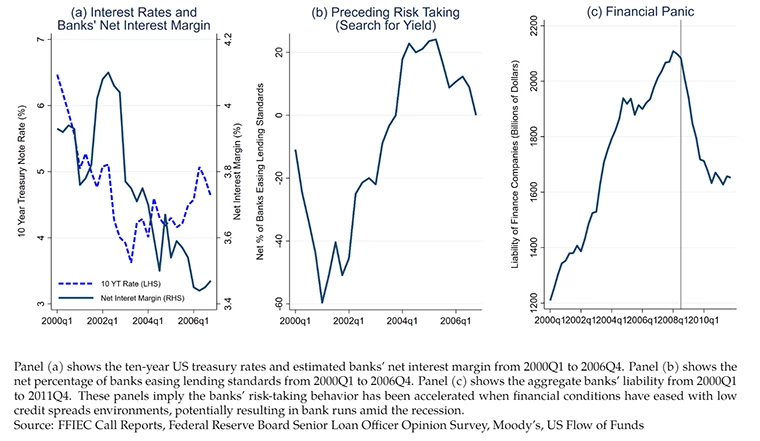

My job market paper analyzes the macroprudential role of monetary policy in a model in which risk taking is characterized by endogenous asset risk that increases the probability of nonlinear financial panic and financial panics. To motivate the analysis, figure 1 displays the correlation between financial panic and banks’ preceding search for yield behavior surrounding the global financial crisis. Panel (a) shows the 10-year U.S. treasury rates and estimated bank net interest margins from 2000Q1 to 2006Q4. Fueled by the global savings glut, low interest rates led to the compression of banks’ spreads or net interest margins in the pre-crisis period. Panel (b) shows the time series of the degree to which banks loosened lending standards from 2000Q1 to 2006Q4.

Figure 1. Financial Panic and Preceding Banks' Risk Taking

This panel is suggestive of the phenomenon that banks extended more loans to riskier borrowers before the financial crisis. Panel (c) shows banks’ aggregate liabilities from 2000Q1 to 2011Q4. The figure illustrates the enormous withdrawal of bank liabilities and creditors after Lehman Brothers defaulted in 2008Q3, which captures the banking sector’s run behavior. These three panels are suggestive of how the ease of financial environments accelerated banks’ risk-taking behavior, which then triggered financial panic.

While bank risk-taking behavior on the asset side plays a crucial role in determining the probability of financial panic events, few extant works in the literature feature endogenous bank risk taking, and the interaction of this type of risk with financial panics is absent in the macro literature. This paper helps fill this gap by proposing a macroeconomic model in which banks’ asset risk taking and financial panics are endogenous. My calibrated model indicates that the likelihood of observing a financial panic in a recession is 34% higher in an economy with endogenous risk taking than one in which banks asset risk is unchanged. In addition, I evaluate the welfare impact of augmenting the Taylor rule1 with financial variables to respond to banks’ risk-taking behavior. I find that this augmented Taylor rule can potentially increase the economy’s welfare by 20% compared with a standard Taylor rule.

The paper starts by providing novel empirical evidence on the effect of U.S. bank-level balance sheet data on pre-crisis risk taking in bank-run behavior. Using data from the Federal Financial Institutions Examination Council’s Call Reports, I estimate the effect of individual banks’ pre-crisis (2003 to 2007) increase in risk on assets (risk-weighted assets) on wholesale funding withdrawal (reduction in wholesale lending) between 2008 and 2010, which represents the bank-run behavior in the wholesale funding market. The estimation results demonstrate that the banks that took more risk pre-crisis experienced larger withdrawals during the financial crisis.

Motivated by these empirical facts, I develop a macroeconomic model with banks to quantify the relative importance of endogenous asset risk taking and evaluate the welfare gain of the augmented interest rate policy. To micro-found the banks’ risk-taking incentives and their effect on financial panics, I combine two conventional building blocks. First, bank asset risk is determined through the banks’ choice of how intensely to monitor firms’ projects. The monitoring decision governs the success probability of firms’ projects but entails costs. Second, depositors choose to roll over their deposits based on their perceptions of banks’ balance sheets and risk choice, which introduces the possibility of financial panics. Crucially, these two building blocks are intrinsically linked in the model: when credit spreads compress during economic booms, banks have an incentive to reduce monitoring intensity and hold riskier assets (“search for yield”). As a result, a modest-sized negative shock to the economy in a recession can trigger a financial panic in the endogenous risk-taking economy. In this way, my paper illustrates how increased asset risk taking during a boom increases vulnerability to financial panic . As a result, the model simulation indicates that the likelihood of observing a financial panic in a recession is 34% higher in an economy with endogenous risk taking than one in which banks’ asset risk is unchanged.

Furthermore, my model highlights the macroprudential role of monetary policy through the augmented interest rate rule. Specifically, I employ a Taylor rule with a financial term (banks’ net worth) to characterize this augmented interest rate rule. Higher interest rates introduced by this augmented Taylor rule moderate the compression of expected credit spreads, reducing risk-taking behavior during financial booms. The optimal augmented rule indicates approximately 2% (annual) higher rates on average during the financial boom as compared to those suggested by a standard Taylor rule with only an inflation term. The augmented Taylor rule can potentially increase the economy’s welfare by 20% compared with a standard Taylor rule.

Summary of Policy Implications

My results raise two key policy implications. First, increased asset risk taking by banks during a boom increases vulnerability to financial panic. Second, monetary policy can play a role in the macroprudential aspect by setting interest rates higher during the financial boom, as higher interest rates unwind the compression of the credit spread and hence the banks’ risk-taking behavior . The augmented interest rate rule that accounts for the financial boom increases the welfare of the economy compared with the interest rate in the policy rule that does not account for the financial dynamics, by reducing banks’ asset risk-taking behavior and hence the probability of financial panic.

1 This type of interest rate rule is widely adopted by central banks. It determines interest rates based on inflation and output gap, generally.

Mai Hakamada is a PhD candidate of economics at the University of California, Santa Cruz. More about her research can be found here.

Join the Conversation